When the going gets tough, the tough get going... working harder and focused on meeting their challenges. The tough ones in our business are those who can convince cautious customers to buy in an exceptionally challenging economic environment.

For many industries and organization, 2020 was a difficult year and indications are that 2021 will be difficult as well. Sellers who want to be successful need to toughen up and overcome the challenges before them. The best way to triumph over uncertainty is through value selling.

Assessing Uncertainty

Everyone abhors uncertainty: the markets, industries, companies, and especially your sales reps. But it is difficult to plan and nearly impossible to forecast when you don’t know what’s coming.

COVID-19 continues to have a profound impact on the economy. Will the vaccines be effective? How long will they last? Will enough people take the vaccine? When will businesses fully reopen? How long until people begin traveling for business again? Will there be lasting, or even permanent, changes to market sectors?

Also unknown are the ramifications of a newly-elected administration and other changes in government leadership. How will taxes and regulations change? Will attitudes towards certain industries change? How will approaches toward economic stimulus change?

Businesses are asking these and many more questions as they assess the future and continued economic uncertainty. How should companies react to ensure continued productivity and profitability?

Reacting to Uncertainty

Companies often respond to uncertainty with measures that reduce financial risk: hiring freezes, budget cuts, and raising the thresholds for investment approvals. When times are tenuous, cash becomes king. One client told us that their company had gone into “cash preservation mode.”

Leadership also increases its financial scrutiny of any investment, making approval more difficult to obtain. Even approved budgets may be revisited and justified all over again before funds are released. Also shifting are the metrics that are used to evaluate investments. ROI and NPV are likely to shift to risk/confidence and Payback Period,

Triumphing Over Uncertainty

One of the best ways to overcome this increased scrutiny is to develop a realistic business case that shows a short Payback Period for the investment.

Loosely defined, the Payback Period is the point at which the cash benefits derived from the investment become greater than the initial investment. As an example, buying a more fuel-efficient car comes at a premium. The Payback Period of the incremental investment is the point at which the fuel savings become greater than the premium paid for the car.

When companies are in cash preservation mode, that Payback Period may be as short as six months, but is not likely longer than 12 months. More importantly, they will likely discount the probability of those cash benefits even becoming reality.

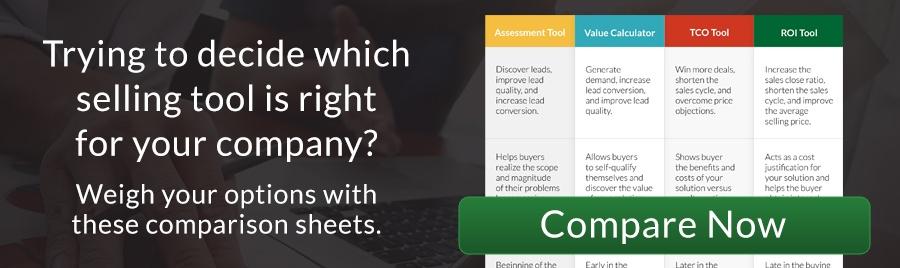

Building a business case strong enough to overcome cash preservation mode requires an honest analysis of the cash benefits the customer is likely to receive from their investment in your offering. This often requires using Value Calculators and ROI Tools to model the projected cash flow.

If the Payback Period (discounted, of course, to account for how the financial decision makers will look at it) is too long, you may need to consider alternative pricing models. This doesn’t necessarily need to take the form of lowering prices, although in some cases it may, but it could take the form of guarantees or deferred payments.

In the end, you need to demonstrate to the customer that their cash position will be better in a short period of time after investing in your offering.

Conclusion

In the words Hippocrates, the ancient Greek physician, “desperate times call for desperate measures.” In an uncertain economic environment, you may need to pull out all of the stops to win business. That means digging deep and clearly demonstrating to potential customers that investing in your offering is a good financial decision. And most likely that needs to be in terms of cash flow and Payback Period.

Companies will still make investments if they make financial sense, so make sure your proposal makes cents (and dollars too).

Resources

Connect with Darrin Fleming on LinkedIn.

Join the Value Selling for B2B Marketing and Sales Leaders LinkedIn Group.

Visit the ROI Selling Resource Center.