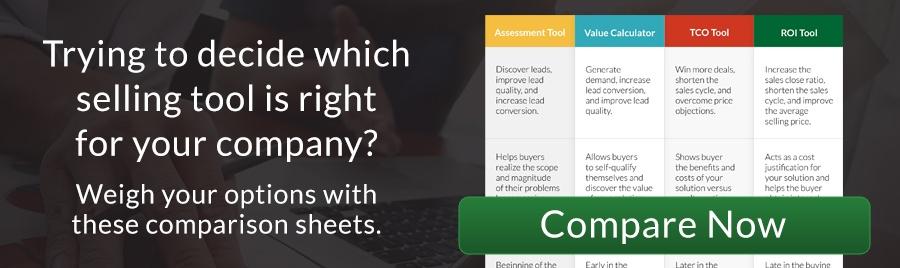

Total Cost of Ownership (TCO) and Return On Investment (ROI) seem to be similar methods of proving cost effectiveness, but they perform best in totally different situations.

In fact, if you use a TCO tool at the wrong time in the sales process, you are taking a couple of big risks. Let's take a closer look at ROI vs. TCO and which tool is better for your business.

Total Cost of Ownership

Total Cost of Ownership, or TCO, shows a financial comparison between your solution and that of a competitor. The very definition of TCO indicates you need two or more alternatives in your calculations because your intent is to show your solution is a better financial option.

Used at the right time, TCO can help win more deals, and it can certainly be the clincher to a fast close. It also provides a robust response to objections about price. If you are losing deals to your competitors or competing technologies and materials, TCO provides a framework for comparison to help build the business case for your solution.

Your buyer will easily see the costs and benefits of your solution over the competition’s. Inside or outside sales and your channel partners should be educated to use TCO tools when it is time to make such a comparison and not before.

TCO is a metric that can make your solution stand out next to the competition; an important task when decision time has come. However, if you deploy it too early, you run the risk of introducing your buyer to the competition. On the other hand, if you wait too late, you will lose the chance to convince the buying committee or the finance executives to purchase your solution over someone else’s.

Return On Investment

Return On Investment (ROI) is a metric that can get the customer off the dime. If you have issues with losing sales to “no-decision” or finding yourself discounting your price too often, ROI tools will help you show buyers the cost of delaying and justify the price you are asking.

ROI provides the cost justification in support of the business case and a valuable illustration to the buying committee and financial team. Showing superior ROI can increase the sales close ratio, increase your average selling price, and shorten the sales cycle.

An increased sales close ratio is the result of showing, in numbers, what a buyer is sacrificing by not taking action. The buyer discovers a drain on the budget and then realizes the plug to stop it immediately is available.

Showing buyers how much is being lost every day is also a great way to shorten the sales cycle since the solution must go in as soon as possible to stop the hemorrhaging.

Finally, your average selling price will go up because you will no longer need to discount as often (if at all) to close the sale.

Ultimately, being able to show ROI removes one of the biggest obstacles to closing a sale: The question of whether the solution will pay for itself and how quickly.

Coach inside and outside sales as well as your channel partners on the value of using ROI to effectively and efficiently close the sale. It isn’t that often that a sale comes down to two closely matched competitors, so ROI will position you as the only viable option to solve the customer’s problem.

If, however, you are in a situation where a competitor or alternative has already been identified and is in contention to win the deal, TCO can plainly show your better value.